Get Your Freight Broker Bond (BMC-84) Fast & Easy

Whether you’re starting a new brokerage or need to renew your bond, our team is here to help every step of the way. Fill out our quick online application or give us a call – and we’ll get your bond issued fast.

Why Choose Us?

Buy BMC-84 Bond Online in 3 Easy Steps

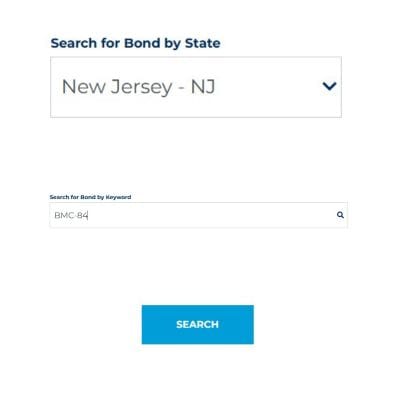

Select State & Bond

Step 1.

Select your State and type “BMC-84” in the search bar and press the search button.

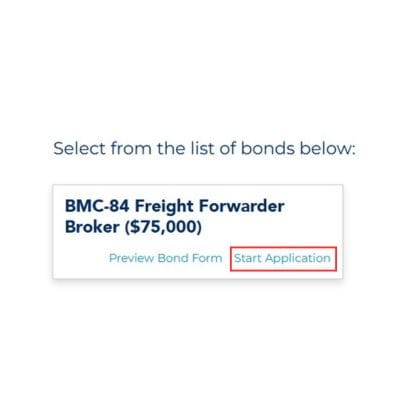

Preview Form & Application

Step 2.

Select the preview form or start an application for BMC-84 surety bond.

Complete The Application

Complete the application and press next button. Your application will be submitted automatically for underwriting.

What is a Freight Broker Bond (BMC-84)?

A Freight Broker Bond, also known as a BMC-84, is a $75,000 surety bond required by the FMCSA (Federal Motor Carrier Safety Administration) for all freight brokers and freight forwarders. It ensures that brokers operate with honesty and integrity, and protects carriers and shippers in the event of non-payment or fraud.

surety bond value:

$75,000

(FMCSA) Requirement

Get your bond issued in as little as 24 hours so you can start operating without delays.

Apply Today – Start Moving Freight Tomorrow

Whether you’re starting a new brokerage or need to renew your bond, our team is here to help every step of the way. Fill out our quick online application or give us a call – and we’ll get your bond issued fast.